Table of contents

- Understanding Trading Psychology

- Common Psychological Challenges

- Mastering Emotional Discipline

- The Importance of a Trading Plan

- Risk Management and Psychology

- Psychological Tools for Success

- Learning from Mistakes

- Conclusion

The Mind Game of Trading: Mastering Trading Psychology

Trading is often seen as a battle of wits, where your greatest opponent is not the market, but your own mind. Trading psychology plays a pivotal role in the success of traders. Emotions, discipline, and mindset can either propel you to profits or lead to costly mistakes. In this blog, we will delve deep into the world of trading psychology, exploring the key psychological aspects that traders must master to thrive in the financial markets.

- The Role of Emotions

- The Psychological Rollercoaster

Understanding Trading Psychology

- Fear and Greed

- Overconfidence

- Impatience

Common Psychological Challenges

- Emotional Awareness

- Developing Emotional Control

Mastering Emotional Discipline

- Setting Clear Goals

- Creating a Trading Routine

The Importance of a Trading Plan

- Managing Losses

- Dealing with Winning Streaks

Risk Management and Psychology

- Visualization

- Meditation and Mindfulness

- Journaling

Psychological Tools for Success

- Embracing Losses as Lessons

- Avoiding Revenge Trading

Learning from Mistakes

How can we showcase your brokerage?

Understanding Trading Psychology

The Role of Emotions

Emotions are an integral part of trading. Fear, greed, hope, and anxiety can all influence trading decisions. Understanding how emotions impact your choices is crucial for maintaining a balanced perspective.

The Psychological Rollercoaster

Trading often involves intense emotional highs and lows. The thrill of winning and the frustration of losing can lead to impulsive decisions. It’s essential to navigate this rollercoaster with composure.

Common Psychological Challenges

-

01

Fear and Greed

Fear can paralyze decision-making, leading to missed opportunities. Conversely, greed can drive excessive risk-taking. Recognizing these emotions and finding a balance is key.

-

02

Overconfidence

Overestimating your abilities can be detrimental. Avoid assuming that past success guarantees future gains. Stay humble and keep learning.

-

03

Impatience

Impatience can lead to premature exits or entries. Trading requires discipline and the ability to wait for the right opportunities.

Mastering Emotional Discipline

Emotional Awareness

Acknowledge your emotions and their influence on your trading decisions. Are you trading out of fear, greed, or discipline? Self-awareness is the first step towards control.

Developing Emotional Control

Implement strategies to manage emotions effectively. Techniques such as deep breathing or taking breaks during stressful moments can help regain emotional balance.

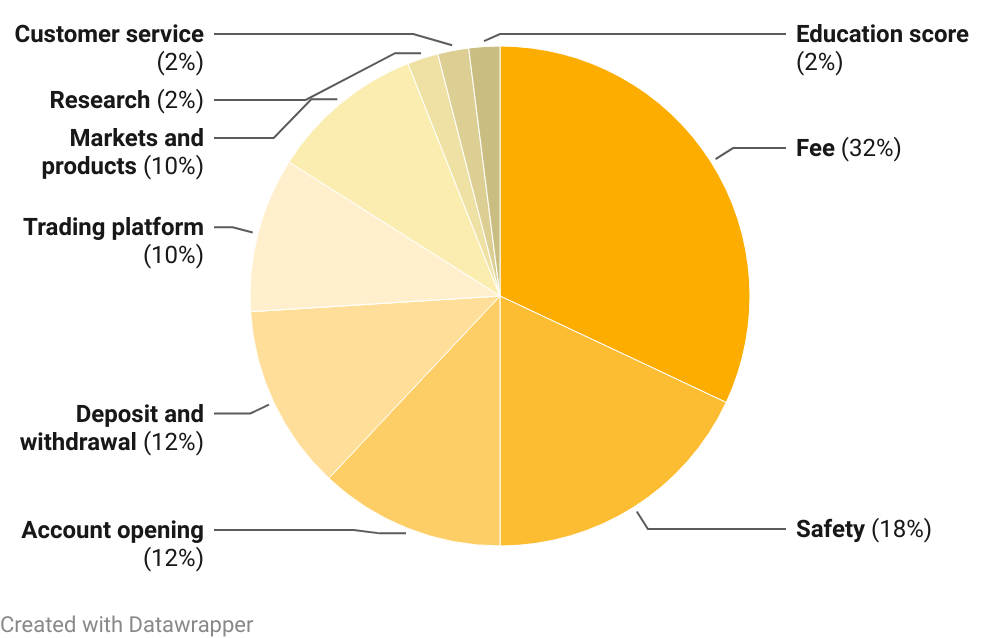

Weight Of Areas In The Methodology

The Importance of a Trading Plan

Setting Clear Goals

A well-defined trading plan outlines your goals, strategies, and risk management rules. Having a plan reduces uncertainty and emotional reactions to market movements.

Creating a Trading Routine

Establish a consistent trading routine. This creates a sense of structure and helps reduce anxiety. Stick to your plan even during times of uncertainty.

Risk Management and Psychology

Managing Losses

Accept that losses are a part of trading. Implement risk management strategies, such as setting stop-loss orders, to limit potential losses and protect your capital.

Dealing with Winning Streaks

Success can breed overconfidence. Stick to your trading plan, even during winning streaks, to prevent reckless decisions that could wipe out gains.

Psychological Tools for Success

Visualization

Mentally rehearsing successful trades can boost confidence and help you react calmly during volatile market conditions.

Meditation and Mindfulness

Practices like meditation and mindfulness can improve emotional control and focus. These techniques are valuable for staying grounded in high-pressure situations.

Journaling

Maintain a trading journal to track your decisions, emotions, and outcomes. It provides insights into your trading psychology and helps you learn from past mistakes.

Learning from Mistakes

Embracing Losses as Lessons

Losses can be valuable teachers. Analyze losing trades to identify patterns of behavior or decision-making that need improvement.

Avoiding Revenge Trading

Revenge trading, attempting to recover losses through impulsive trades, can lead to further losses. Recognize this destructive pattern and avoid it at all costs.

Conclusion

Trading psychology is often the difference between success and failure in the financial markets. Understanding your emotions, maintaining emotional discipline, and having a solid trading plan are essential components of mastering the psychological aspects of trading. By consistently practicing self-awareness, emotional control, and the techniques outlined in this blog, you can navigate the emotional highs and lows of trading more effectively. Remember that trading is a marathon, and maintaining a strong psychological foundation is key to long-term success in this demanding field.