Table of contents

- Table of Contents

- Understanding the Basics

- Trading Instruments

- Trading Terminology

- Setting up a Trading Account

- Risk Management

- Trading Strategies

- Psychology of Trading

- Legal and Tax Considerations

- Continuous Learning

- Conclusion

The Basics of Trading: A Comprehensive Guide

Trading has been an integral part of human civilization for centuries, dating back to ancient times when people exchanged goods and services. Today, trading has evolved into a sophisticated financial market where individuals and institutions buy and sell various assets, such as stocks, bonds, currencies, and commodities, in pursuit of profit. If you’re interested in learning the basics of trading, you’ve come to the right place. This guide will provide you with an overview of trading, its fundamental concepts, and key strategies to help you get started.

- What is Trading?

- Types of Trading

- Trading Markets

Understanding the Basics

- Stocks

- Bonds

- Currencies

- Commodities

- Derivatives

Trading Instruments

- Orders and Trades

- Bid and Ask Price

- Market vs. Limit Orders

- Volatility

Trading Terminology

- Choosing a Broker

- Account Types

- Research Tools

Setting up a Trading Account

- Risk vs. Reward

- Stop Loss Orders

- Diversification

Risk Management

- Day Trading

- Swing Trading

- Long-Term Investing

- Technical Analysis

- Fundamental Analysis

Trading Strategies

- Emotions in Trading

- Discipline

- Risk Tolerance

Psychology of Trading

- Tax Implications

- Regulations

Legal and Tax Considerations

- Books and Courses

- Following the News

- Paper Trading

Continuous Learning

How can we showcase your brokerage?

Understanding the Basics

-

01

What is Trading?

Trading involves the buying and selling of financial assets with the goal of making a profit. Traders aim to capitalize on price fluctuations in various markets. The basic principle is to buy low and sell high (or short-sell high and buy back low in the case of short selling).

-

02

Types of Trading

There are several trading styles, including day trading (buying and selling within the same trading day), swing trading (holding positions for several days or weeks), and long-term investing (buying and holding for years).

Trading is a dynamic field with various strategies and approaches to capitalize on financial markets’ movements. Here, we’ll explore some of the primary types of trading:

- Definition: Day trading involves buying and selling financial instruments within the same trading day. Day traders aim to profit from short-term price fluctuations.

- Strategy: Day traders rely on technical analysis, charts, and short-term indicators to identify intraday opportunities. They make quick decisions, often executing multiple trades daily.

- Challenges: Day trading demands intense focus and discipline. It can be emotionally taxing, as rapid decisions are necessary, and losses can mount quickly.

Day Trading:

- Definition: Swing trading involves holding positions for several days to weeks, aiming to capture intermediate-term price movements.

- Strategy: Swing traders use technical analysis to identify potential entry and exit points within a broader trend. They seek to profit from price swings within these trends.

- Challenges: Swing trading requires patience and the ability to tolerate short-term price fluctuations, as positions are held for more than a day.

Swing Trading:

- Definition: Position trading is a long-term approach where traders hold positions for weeks, months, or even years. It often relies on fundamental analysis.

- Strategy: Position traders focus on broader economic and fundamental factors. They aim to capture major trends and may tolerate short-term market fluctuations.

- Challenges: Position trading requires a deep understanding of fundamentals and the ability to withstand market volatility over extended periods.

Position Trading:

- Definition: Scalping involves making rapid, small trades to profit from tiny price movements. Scalpers aim to make numerous small gains throughout the trading day.

- Strategy: Scalpers use very short timeframes and may rely on technical analysis, order flow data, and level II quotes for quick trade execution.

- Challenges: Scalping demands quick decision-making and execution. Transaction costs can accumulate due to the high trade frequency.

Scalping:

- Definition: Algorithmic trading (algo trading) uses computer algorithms to automate trading decisions and execution. These algorithms analyze vast amounts of data and execute trades at high speeds.

- Strategy: Algo trading strategies can vary from statistical arbitrage to trend following. Traders often backtest algorithms to optimize performance.

- Challenges: Developing effective algorithms requires programming skills and a deep understanding of market dynamics. Monitoring and fine-tuning algorithms are ongoing processes.

Algorithmic Trading:

- Definition: Options trading involves buying and selling options contracts, which provide the right, but not the obligation, to buy or sell an underlying asset at a specified price (the strike price) by a certain date (the expiration date).

- Strategy: Options traders use various strategies, like covered calls, straddles, and spreads, to profit from price movements, volatility changes, or income generation.

- Challenges: Options trading can be complex, requiring a solid grasp of option pricing models and strategies.

Options Trading:

- Definition: Forex (foreign exchange) trading involves trading currency pairs in the global currency market. Traders speculate on the relative strength of one currency against another.

- Strategy: Forex traders use technical and fundamental analysis to make trading decisions. Leverage is common in forex, amplifying both gains and losses.

- Challenges: The 24-hour nature of forex can lead to significant market volatility. Risk management is crucial in forex trading.

Forex Trading:

- Definition: Cryptocurrency trading involves buying and selling digital currencies like Bitcoin and Ethereum on cryptocurrency exchanges.

- Strategy: Crypto traders use technical analysis, market sentiment, and news events to make trading decisions. The crypto market is known for its high volatility.

- Challenges: Cryptocurrency markets are relatively new and can be highly speculative. Security concerns and regulatory developments add complexity.

Cryptocurrency Trading:

- Definition: Commodity trading involves buying and selling physical goods like oil, gold, and agricultural products or trading commodity futures contracts.

- Strategy: Commodity traders monitor supply and demand fundamentals, geopolitical events, and technical factors to make trading decisions.

- Challenges: Commodity prices can be influenced by factors like weather conditions and geopolitical tensions, making this market unpredictable.

Commodity Trading:

- Definition: Social trading platforms allow traders to follow and copy the trades of experienced investors, combining social networking with trading.

- Strategy: Social traders select experienced traders to follow, and their accounts mirror the trades of those they follow automatically.

- Challenges: Choosing the right traders to follow is crucial, as performance can vary. It’s essential to understand the strategies of the traders being followed.

Social Trading:

Trading Markets:

Trading can occur in various markets, such as stock markets (e.g., New York Stock Exchange), forex markets (foreign exchange), commodities markets (e.g., oil and gold), and cryptocurrency markets.

Trading Instruments

Stocks

Stocks represent ownership in a company. Traders buy and sell shares of stock to profit from price changes or to receive dividends.

Bonds

Bonds are debt securities issued by governments or corporations. Bond traders profit from fluctuations in bond prices and interest rates.

Currencies

Forex (foreign exchange) trading involves the exchange of one currency for another. Forex traders speculate on currency price movements.

Commodities

Commodity trading involves physical goods like oil, gold, and agricultural products. Traders speculate on future price movements.

Derivatives

Derivatives are financial contracts whose value depends on an underlying asset. This category includes options and futures contracts.

Trading Terminology

Orders and Trades

An order is an instruction to buy or sell an asset, while a trade is the execution of that order.

Bid and Ask Price

The bid price is the highest price a buyer is willing to pay, and the ask price is the lowest price a seller is willing to accept. The difference is called the bid-ask spread.

Market vs. Limit Orders

A market order buys or sells at the current market price, while a limit order specifies a price at which the trader is willing to buy or sell.

Volatility

Volatility measures the degree of price fluctuation in an asset. Highly volatile assets can lead to greater trading opportunities and risks.

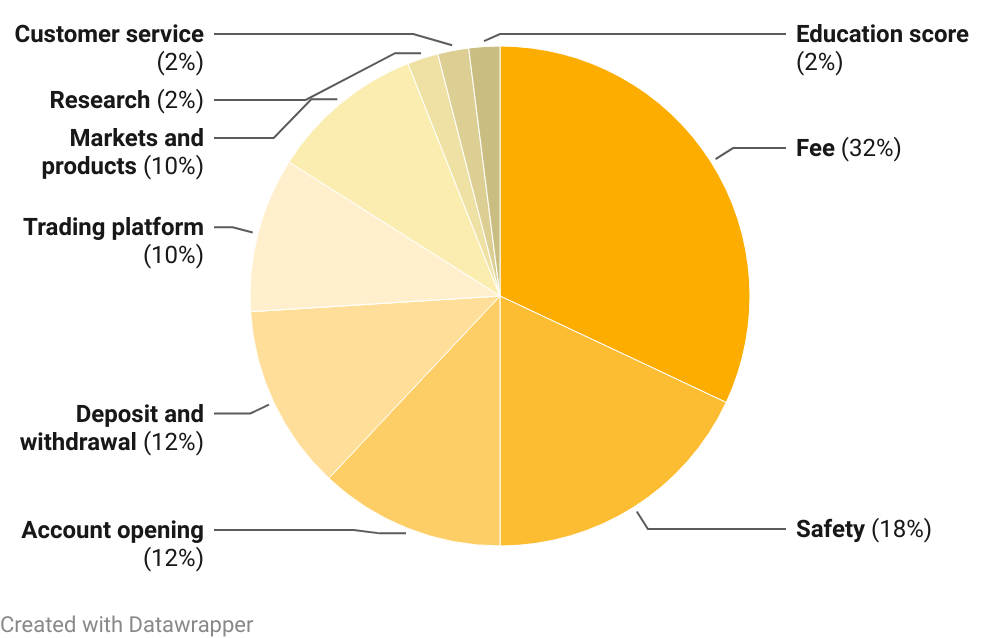

Weight Of Areas In The Methodology

Setting up a Trading Account

Choosing a Broker

Select a reputable brokerage firm that suits your trading needs. Consider factors like fees, trading platform, and research tools.

Account Types

Choose an account type based on your trading style. Common types include cash accounts and margin accounts.

Research Tools

Brokers offer research tools like charts, news feeds, and analysis reports to help you make informed decisions.

Risk Management

Risk vs. Reward

Every trade carries risks. Traders should assess potential risks and rewards before entering a trade.

Stop Loss Orders

A stop loss order sets a predetermined exit point to limit potential losses.

Diversification

Spreading investments across various assets reduces risk. Don’t put all your capital into one trade or asset.

Trading Strategies

Day Trading

Day traders buy and sell assets within a single trading day, capitalizing on short-term price movements.

Swing Trading

Swing traders hold positions for several days or weeks, aiming to profit from intermediate-term trends.

Long-Term Investing

Investors buy and hold assets for the long term, often relying on fundamental analysis.

Technical Analysis

Technical analysts use charts and indicators to forecast price movements.

Fundamental Analysis

Fundamental analysts assess an asset’s intrinsic value based on financial and economic factors.

Psychology of Trading

-

01

Emotions in Trading

Emotions like fear and greed can cloud judgment. Maintain discipline and stick to your trading plan.

-

02

Discipline

Follow a set of rules and strategies consistently to minimize impulsive decisions.

-

03

Risk Tolerance

Understand your risk tolerance and only trade with money you can afford to lose.

Legal and Tax Considerations

Tax Implications

Understand the tax treatment of trading gains and losses in your jurisdiction.

Regulations

Comply with the regulatory requirements of your country or region, including disclosure and reporting obligations.

Continuous Learning

Books and Courses

Many resources are available for traders, from books to online courses. Stay updated with the latest strategies and techniques.

Following the News

Global events and economic indicators can significantly impact financial markets. Stay informed.

Paper Trading

Practice trading with virtual money in a simulated environment to gain experience without real financial risk.

Conclusion

Trading is a complex but rewarding endeavor that requires a combination of knowledge, discipline, and experience. Start small, develop a trading plan, and continuously educate yourself. Remember that trading carries risks, and it’s possible to lose more than your initial investment. By following the basics outlined in this guide and maintaining a cautious approach, you can embark on your trading journey with confidence and a higher chance of success.