Table of contents

- Table of Contents

- Understanding Investment Funds

- Benefits and Drawbacks of Investment Funds

- Common Types of Investment Funds

- Selecting the Right Investment Fund

- Strategies for Trading with Investment Funds

- Risk Management with Investment Funds

- Tax Considerations for Fund Trading

- Funds as Part of a Trading Portfolio

- Investing in Funds for the Long Term

- Conclusion

Navigating Investment Funds in Trading: A Comprehensive Guide

Investment funds are a popular choice for traders looking to diversify their portfolios and mitigate risk. These funds, managed by professionals, pool money from multiple investors to invest in a range of assets. In this comprehensive guide, we’ll explore the world of investment funds, discussing the various types, strategies, and considerations that traders should be aware of when using funds as part of their trading strategy.

- What Are Investment Funds?

- Why Invest in Funds?

- Types of Investment Funds

Understanding Investment Funds

- Advantages of Funds

- Potential Drawbacks

Benefits and Drawbacks of Investment Funds

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Hedge Funds

- Index Funds

Common Types of Investment Funds

- Defining Your Investment Goals

- Assessing Risk Tolerance

- Considering Fees and Expenses

Selecting the Right Investment Fund

- Asset Allocation

- Passive vs. Active Management

- Thematic and Sector Funds

Strategies for Trading with Investment Funds

- Diversification

- Setting Realistic Expectations

- Regular Portfolio Review

Risk Management with Investment Funds

- Tax Efficiency

- Capital Gains and Dividend Taxes

Tax Considerations for Fund Trading

- Combining Funds with Other Investments

- Asset Allocation Strategies

Funds as Part of a Trading Portfolio

- Retirement Planning

- Building Wealth Gradually

- Rebalancing Your Portfolio

Investing in Funds for the Long Term

Conclusion

How would we feature you?

Understanding Investment Funds

What Are Investment Funds?

Investment funds are pooled investment vehicles that collect money from multiple investors to purchase a diversified portfolio of assets, including stocks, bonds, real estate, or commodities. These funds are managed by professional fund managers.

Why Invest in Funds?

Investment funds offer diversification, professional management, and accessibility to a wide range of assets. They are particularly beneficial for investors who lack the time, expertise, or capital to manage a diversified portfolio themselves.

Types of Investment Funds

There are various types of investment funds, including mutual funds, ETFs, hedge funds, and index funds. Each has its unique characteristics and investment strategies.

Benefits and Drawbacks of Investment Funds

-

01

Advantages of Funds

Diversification: Funds spread investments across various assets, reducing risk.

Professional Management: Fund managers make informed investment decisions on behalf of investors.

Accessibility: Funds are readily available to individual investors.

-

02

Potential Drawbacks

Fees and Expenses: Management fees and expenses can reduce returns.

Lack of Control: Investors relinquish control over specific investment decisions to fund managers.

Tax Implications: Tax treatment of fund investments can impact returns.

Common Types of Investment Funds

Mutual Funds

Mutual funds pool money from investors to invest in a diversified portfolio of securities. They are actively managed and typically suited for long-term investors.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges. They offer intraday trading and are known for their liquidity and transparency.

Hedge Funds

Hedge funds employ various strategies, including long and short positions, leverage, and derivatives, with the goal of generating absolute returns. They are typically open to accredited investors.

Index Funds

Index funds aim to replicate the performance of a specific market index, such as the S&P 500. They are passively managed and often have lower fees.

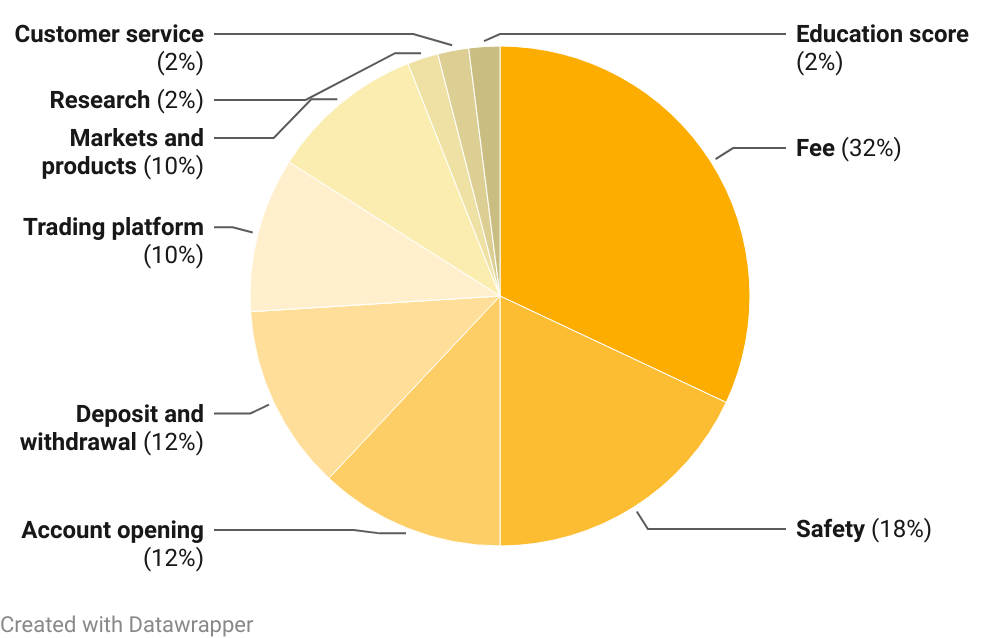

Weight Of Areas In The Methodology

Selecting the Right Investment Fund

Defining Your Investment Goals

Determine your financial objectives, such as saving for retirement, purchasing a home, or generating income. Your goals should guide your fund selection.

Assessing Risk Tolerance

Evaluate your risk tolerance, considering factors like age, financial stability, and investment experience. Risk tolerance influences your asset allocation.

Considering Fees and Expenses

Compare the fees and expenses associated with different funds. Lower expenses can significantly impact long-term returns.

Strategies for Trading with Investment Funds

Asset Allocation

Allocate your investments across different asset classes, such as stocks, bonds, and cash, to achieve a balanced portfolio that aligns with your risk tolerance and goals.

Passive vs. Active Management

Decide whether you prefer passive funds (e.g., index funds) that aim to match market performance or actively managed funds (e.g., mutual funds) that seek to outperform the market.

Thematic and Sector Funds

Consider thematic or sector-specific funds that focus on particular industries or themes, such as technology or sustainable investing, to align with your interests or beliefs.

Risk Management with Investment Funds

-

01

Diversification

Diversify your portfolio by investing in a mix of asset classes and geographic regions. Diversification helps reduce risk by limiting exposure to any single investment.

-

02

Setting Realistic Expectations

Understand that all investments carry some degree of risk. Set realistic return expectations based on your chosen funds and investment strategy.

-

03

Regular Portfolio Review

Periodically review your portfolio to ensure it aligns with your goals and risk tolerance. Make adjustments as needed to maintain a balanced allocation.

Tax Considerations for Fund Trading

Tax Efficiency

Choose tax-efficient funds that minimize tax liabilities, such as ETFs, which often have lower capital gains distributions.

Capital Gains and Dividend Taxes

Understand how capital gains and dividend income from funds are taxed. Consider tax-advantaged accounts for tax-efficient investing.

Funds as Part of a Trading Portfolio

Combining Funds with Other Investments

Incorporate funds into a diversified portfolio that may include individual stocks, bonds, and other assets. Diversification across different investments can enhance risk-adjusted returns.

Asset Allocation Strategies

Implement asset allocation strategies, such as the Modern Portfolio Theory (MPT) or tactical asset allocation to optimize your portfolio’s risk-return profile.

Investing in Funds for the Long Term

Retirement Planning

Funds can be a valuable component of retirement planning, helping investors build a nest egg over time. Regular contributions and prudent asset allocation are key.

Building Wealth Gradually

Investing in funds over the long term harnesses the power of compounding, allowing your investments to grow steadily over time.

Rebalancing Your Portfolio

Periodically review and rebalance your portfolio to maintain your desired asset allocation and align with your long-term goals.

Conclusion

Investment funds provide a convenient and effective way for traders to diversify their portfolios, access professional management, and achieve their financial goals. By understanding the various types of funds, assessing risk tolerance, and implementing sound strategies, traders can successfully incorporate funds into their trading portfolios. Remember that patience and discipline are essential when investing in funds for the long term, and regular review and adjustments will help you stay on track to meet your financial objectives.