Table of contents

- Table of Contents

- What Are Stocks and ETFs?

- Stocks: Owning a Piece of a Company

- ETFs: Diversified Investment at Your Fingertips

- Getting Started with Stocks and ETFs

- Stock and ETF Research

- Strategies for Stock and ETF Investing

- Risk Management in Stock and ETF Investing

- Tax Considerations

- Investing for the Long Term

- Conclusion

Investing Essentials: Stocks and ETFs Explained

Investing in stocks and exchange-traded funds (ETFs) is a fundamental way for individuals to grow their wealth and achieve financial goals. In this blog, we’ll explore the basics of stocks and ETFs, providing you with a comprehensive understanding of these investment vehicles and how they can play a role in your investment strategy.

- Defining Stocks

- Introducing ETFs

What Are Stocks and ETFs?

- How Stocks Work

- Types of Stocks

- Investing in Individual Stocks

Stocks: Owning a Piece of a Company

- Understanding ETFs

- Advantages of ETFs

- Different Types of ETFs

ETFs: Diversified Investment at Your Fingertips

- Choosing an Investment Account

- Building a Balanced Portfolio

- Risk Tolerance Assessment

Getting Started with Stocks and ETFs

- Fundamental Analysis

- Technical Analysis

- Valuable Resources

Stock and ETF Research

- Buy and Hold

- Dollar-Cost Averaging (DCA)

- Value Investing

- Dividend Investing

Strategies for Stock and ETF Investing

- Diversification

- Stop-Loss Orders

- Portfolio Rebalancing

Risk Management in Stock and ETF Investing

- Capital Gains Tax

- Dividend Tax

- Tax-Efficient Investing

Tax Considerations

- The Power of Compounding

- Retirement Planning

- Setting Financial Goals

Investing for the Long Term

Conclusion

How would we feature you?

What Are Stocks and ETFs?

Defining Stocks

Stocks, also known as equities or shares, represent ownership in a company. When you own a stock, you own a share of that company’s assets and earnings. Stocks are bought and sold on stock exchanges.

Introducing ETFs

ETFs, or exchange-traded funds, are investment funds that hold a diversified portfolio of assets such as stocks, bonds, or commodities. ETFs are traded on stock exchanges like individual stocks, making them a convenient way to access diversified investments.

Stocks: Owning a Piece of a Company

-

01

How Stocks Work

Stocks provide investors with an opportunity to participate in a company’s growth and success. Stockholders may benefit from capital appreciation (increased stock price) and dividends (a portion of the company’s profits).

-

02

Types of Stocks

Common Stocks: Represent ownership in the company with voting rights.

Preferred Stocks: Offer fixed dividends but often have limited or no voting rights.

-

03

Investing in Individual Stocks

Investing in individual stocks allows you to handpick companies you believe have growth potential. It requires research and careful selection.

ETFs: Diversified Investment at Your Fingertips

Understanding ETFs

ETFs pool funds from multiple investors to purchase a diversified basket of assets. They offer instant diversification and can track various indexes, industries, or asset classes.

Advantages of ETFs

- Diversification

- Liquidity

- Lower Expenses

- Intraday Trading

Different Types of ETFs

- Stock ETFs: Mimic stock market indexes like the S&P 500.

- Bond ETFs: Invest in a variety of bonds, providing income and diversification.

- Commodity ETFs: Track the prices of commodities like gold or oil.

- Sector ETFs: Focus on specific sectors or industries, such as technology or healthcare.

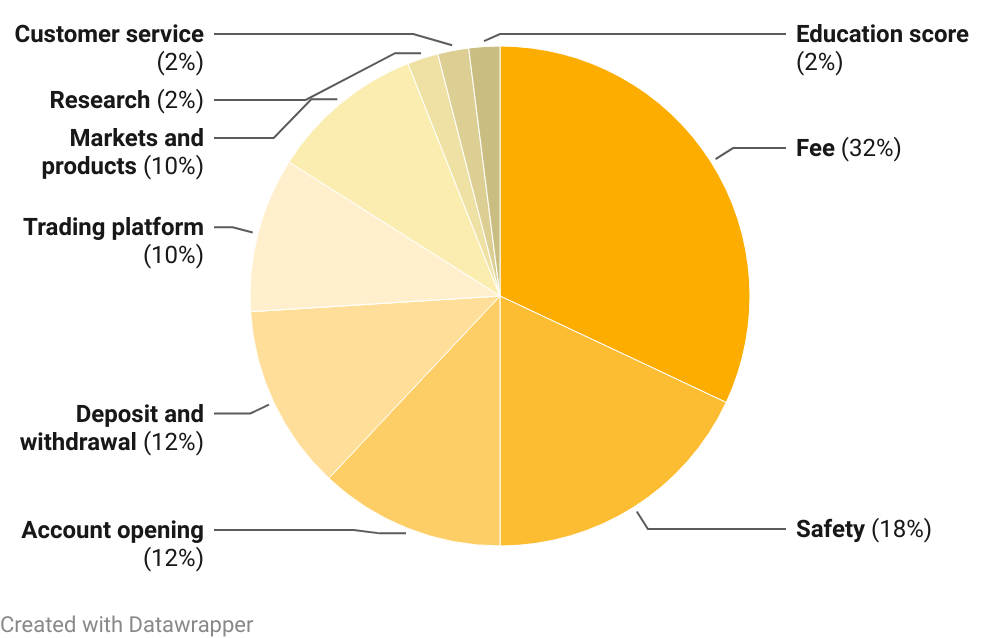

Weight Of Areas In The Methodology

Getting Started with Stocks and ETFs

Choosing an Investment Account

Select the right brokerage account based on your needs, whether it’s a standard brokerage account, individual retirement account (IRA), or a tax-advantaged account like a 401(k).

Building a Balanced Portfolio

Diversify your investments across different asset classes, including stocks, bonds, and cash. A balanced portfolio can help manage risk.

Risk Tolerance Assessment

Understand your risk tolerance, which reflects how comfortable you are with the possibility of losing money. Your risk tolerance influences your investment choices.

Stock and ETF Research

Fundamental Analysis

Evaluate stocks or ETFs by examining financial statements, earnings reports, and business fundamentals. Look at factors like revenue growth, earnings per share, and competitive positioning.

Technical Analysis

Study price charts and technical indicators to make investment decisions. Technical analysis involves identifying trends and potential entry or exit points.

Valuable Resources

Use financial news outlets, research reports, and online tools to gather information and stay informed about your investments.

Strategies for Stock and ETF Investing

-

01

Buy and Hold

Invest with a long-term perspective, aiming to hold assets for years or even decades. This strategy can benefit from compounding and weather market volatility.

-

02

Dollar-Cost Averaging (DCA)

Invest a fixed amount of money at regular intervals, regardless of market conditions. DCA can help reduce the impact of market volatility.

-

03

Value Investing

Look for undervalued stocks or ETFs with growth potential, often based on financial metrics like the price-to-earnings (P/E) ratio.

-

04

Dividend Investing

Focus on stocks or ETFs that provide regular dividend payments, generating passive income.

Risk Management in Stock and ETF Investing

Diversification

Spread your investments across different assets and sectors to reduce risk. A well-diversified portfolio can limit the impact of poor-performing assets.

Stop-Loss Orders

Set stop-loss orders to automatically sell an asset if it reaches a predetermined price. This helps limit potential losses.

Portfolio Rebalancing

Periodically adjust your portfolio to maintain your desired asset allocation. Rebalancing can prevent overexposure to a specific asset class.

Tax Considerations

Capital Gains Tax

Understand how capital gains are taxed based on your holding period. Short-term gains are often taxed at higher rates than long-term gains.

Dividend Tax

Dividend income may be subject to tax. Consider tax-efficient investments for taxable accounts.

Tax-Efficient Investing

Utilize tax-efficient strategies like tax-advantaged accounts to minimize tax liabilities.

Investing for the Long Term

The Power of Compounding

Long-term investing benefits from the compounding effect, where reinvested earnings generate additional returns over time.

Retirement Planning

Stocks and ETFs can play a vital role in retirement planning. Regular contributions and smart investments can help build a nest egg.

Setting Financial Goals

Define clear financial goals, whether it’s buying a home, funding education, or retiring comfortably. Your goals should guide your investment strategy.

Conclusion

Stocks and ETFs are versatile investment tools that can help you build wealth and achieve financial objectives. By understanding the basics, conducting thorough research, employing effective strategies, and managing risks, you can embark on a successful investing journey. Remember that investing is a long-term endeavor, and patience and discipline are key to reaping the rewards of your efforts.