- MetaTrader 4

- MetaTrader 5

- WebTrader

- FSCA(South Africa)

- $100

- 4.5/5

Regulation and Security

Maleyat is regulated by the FSCA (South Africa), which is a highly respected financial regulator. This means that Maleyat is subject to strict requirements, including requirements for capital adequacy, risk management, and client protection.

Maleyat also uses a number of security measures to protect its clients’ funds and data. These measures include:

-

01

Segregated client accounts:

Maleyat keeps client funds segregated from its own funds. This means that client funds are protected even if Maleyat were to go bankrupt.

-

02

Negative balance protection:

Maleyat offers negative balance protection to its clients. This means that clients cannot lose more money than they have deposited in their account.

-

03

Data security:

Maleyat uses a variety of security measures to protect its clients’ data, including encryption and firewalls.

Trading Platforms

Maleyat offers both MetaTrader 4 and MetaTrader 5 trading platforms. MetaTrader 4 and MetaTrader 5 are the most popular forex trading platforms in the world. They are both user-friendly and offer a wide range of features and functionality.

In addition to MetaTrader 4 and MetaTrader 5, Maleyat also offers a web trading platform. The web trading platform is ideal for traders who want to trade forex without having to download any software.

Advantages

- Competitive pricing in terms of spreads and commissions.

- A broad selection of trading products and services.

- User-friendly trading platforms.

- Regulatory compliance under the FSCA (South Africa)

- Strong customer support services.

- A low minimum deposit requirement.

- Swift withdrawal processing

Disadvantages

- A lack of an established track record as a relatively new broker.

- Limited availability of educational resources.

- Absence of a copy trading platform.

- Islamic accounts are not offered.

- High leverage.

- Limited brand recognition in the industry.

- A constrained range of payment options.

Commissions:

For all trades, Maleyat imposes a commission of $0.05 per lot.

Web Platforms:

Maleyat provides access to web-based trading platforms for both MetaTrader 4 and MetaTrader 5.

Deposits & Withdrawals:

Maleyat facilitates deposits and withdrawals through various methods, including bank wire transfer, credit/debit card, and e-wallets. The minimum deposit requirement stands at $100. The broker is known for its swift and efficient withdrawal processing, with most requests completed within 24 hours.

Conclusion:

Maleyat stands as a favorable choice for forex traders in the UAE who seek the services of a trustworthy and regulated broker offering competitive pricing in terms of spreads and commissions, alongside a wide range of trading products and services. However, it is important to acknowledge that Maleyat is a newcomer to the brokerage scene, boasting a limited track record and offering relatively fewer educational resources.

Full Review:

Maleyat is a forex and CFD broker that was founded in 2023. It is headquartered in Dubai, United Arab Emirates, and is regulated by the FSCA (South Africa). Maleyat offers a wide range of trading products and services, including forex, CFDs, and cryptocurrencies.

Deposits & Withdrawals

Maleyat offers a variety of deposit and withdrawal methods, including bank wire transfer, credit/debit card, and e-wallets. The minimum deposit requirement is $100. Withdrawals are processed quickly and efficiently, with most withdrawals being processed within 24 hours.

Instrument Selection

Maleyat offers a wide range of trading products, including:

- Forex: Maleyat offers over 60 currency pairs to trade.

- CFDs: Maleyat offers CFDs on stocks, indices, commodities, and cryptocurrencies.

Account Types

Maleyat offers a variety of account types to suit the needs of different traders. The account types include:

- Standard account: This account type offers commission-free trading with a spread mark-up of 1.1 pips.

- ECN account: This account type offers commission-free trading with a spread mark-up of 0.9 pips.

- Pro account: This account type offers commission-free trading with a spread mark-up of 0.8 pips.

Leverage and Margin

Maleyat offers leverage up to 1:500 for retail traders in the UAE. Leverage allows traders to control large positions with a relatively small amount of capital. However, it is important to note that leverage can also amplify losses.

The margin requirement for forex trading is 2%. This means that traders must have at least $2 for every $100 position they control.

Educational Resources

Maleyat offers a limited range of educational resources for its clients. These resources include:

- Trading articles and videos.

- E-books and trading guides.

Customer Support

Maleyat offers 24/5 customer support in multiple languages. Customer support can be contacted via live chat, email, and phone.

Fees and Spreads

Maleyat offers competitive spreads and commissions. The spreads for the Standard account start at 1.1 pips, the spreads for the ECN account start at 0.9 pips, and the spreads for the Pro account start at 0.8 pips.

Maleyat also charges a commission of $0.05 per lot on all trades.

Evaluation of the most influential parameters of Bull79

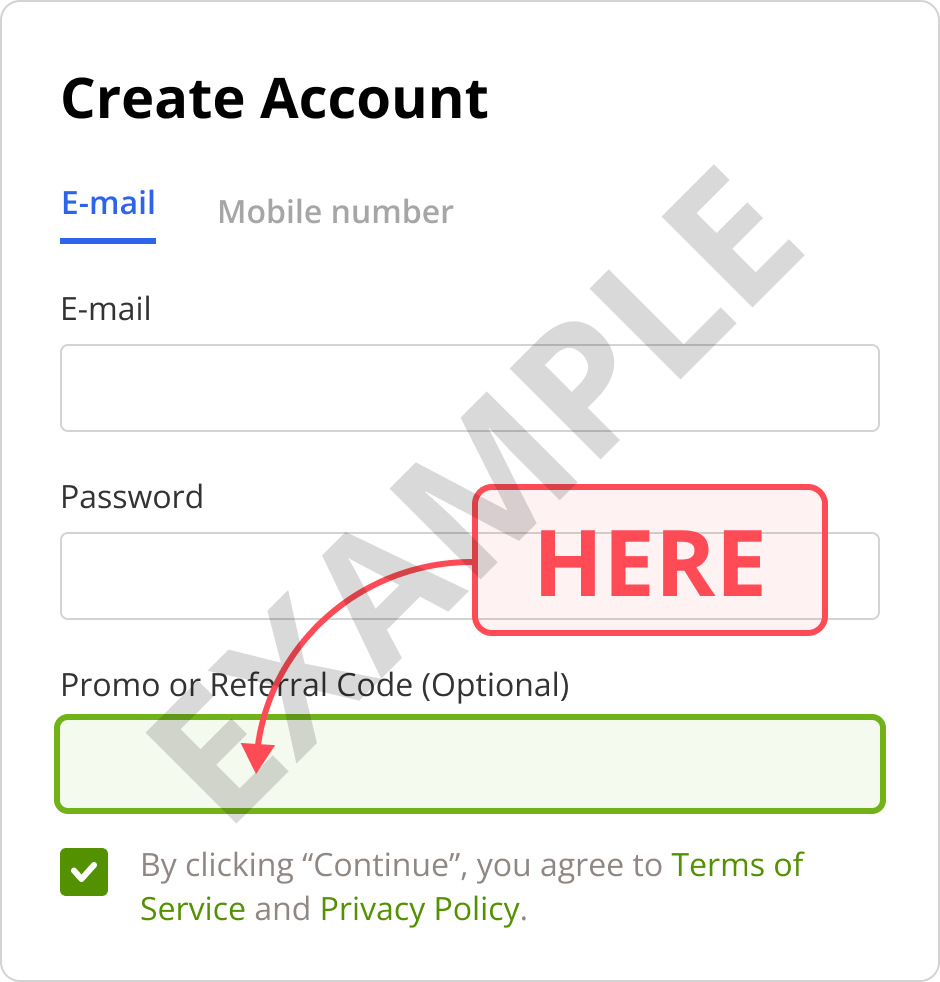

NOTE!

Don’t Miss Out on Exclusive Monthly Bonuses and Extra Trading Payouts with Maleyat!

*Please note that Bull79 may receive a partnership reward for client registrations through their referral link.

Conclusion

Maleyat is a good choice for forex traders in the UAE who are looking for a reliable and regulated broker with competitive spreads and commissions and a wide range of trading products and services. However, it is important to note that Maleyat is a new broker with less track record and limited educational resources.