Table of contents

- Table of Contents

- Understanding Cryptocurrency Trading

- Types of Cryptocurrency Trading

- Setting Up for Crypto Trading

- Basic Crypto Trading Strategies

- Advanced Crypto Trading Strategies

- Risk Management in Crypto Trading

- Technical Analysis in Crypto Trading

- Fundamental Analysis in Crypto Trading

- Psychology of Crypto Trading

- Common Mistakes to Avoid

- Staying Informed and Adapting

- Conclusion

Unlocking the World of Crypto Trading: A Comprehensive Guide

Cryptocurrency trading has taken the financial world by storm. It offers the potential for substantial profits, but it’s also a market known for its high volatility and complexity. Whether you’re a novice looking to get started or an experienced trader seeking to refine your strategy, this comprehensive guide to crypto trading will provide you with the knowledge and tools you need to navigate this exciting and dynamic market.

- What Are Cryptocurrencies?

- How Does Crypto Trading Work?

- Key Cryptocurrency Exchanges

Understanding Cryptocurrency Trading

- Spot Trading

- Futures Trading

- Margin Trading

Types of Cryptocurrency Trading

- Creating a Crypto Wallet

- Choosing a Cryptocurrency Exchange

- Security Measures

Setting Up for Crypto Trading

- HODLing

- Day Trading

- Swing Trading

Basic Crypto Trading Strategies

- Scalping

- Arbitrage

- Algorithmic Trading

Advanced Crypto Trading Strategies

- Position Sizing

- Stop-Loss and Take-Profit Orders

- Managing Emotions

Risk Management in Crypto Trading

- Candlestick Patterns

- Support and Resistance

- Indicators and Oscillators

Technical Analysis in Crypto Trading

- Evaluating Projects and Teams

- News and Events

- Regulatory Considerations

Fundamental Analysis in Crypto Trading

- Overcoming Fear and Greed

- Staying Disciplined

- Learning from Losses

Psychology of Crypto Trading

- Neglecting Security

- Chasing Hype

- Ignoring Diversification

Common Mistakes to Avoid

- Market Research and News

- Adapting to Market Conditions

- Continuous Learning

Staying Informed and Adapting

Conclusion

How would we feature you?

Understanding Cryptocurrency Trading

What Are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate on decentralized blockchain technology and have gained popularity as a medium of exchange and investment.

How Does Crypto Trading Work?

Crypto trading involves buying and selling cryptocurrencies on various exchanges. Traders aim to profit from price fluctuations by predicting whether the price of a cryptocurrency will rise or fall.

Key Cryptocurrency Exchanges

There are numerous cryptocurrency exchanges, each with its own features and offerings. Prominent exchanges include Binance, Coinbase, Kraken, and Bitfinex.

Types of Cryptocurrency Trading

-

01

Spot Trading

Spot trading involves buying or selling actual cryptocurrencies for immediate delivery. It’s the simplest form of crypto trading and is ideal for beginners.

-

02

Futures Trading

Futures trading allows traders to speculate on the future price of cryptocurrencies without owning the underlying assets. It offers leverage but carries higher risk.

-

03

Margin Trading

Margin trading involves borrowing funds to trade larger positions than your account balance. It amplifies both gains and losses and should be approached with caution.

Setting Up for Crypto Trading

Creating a Crypto Wallet

A cryptocurrency wallet is essential for storing your digital assets securely. Choose between hardware wallets, software wallets, and online wallets, depending on your needs.

Choosing a Cryptocurrency Exchange

Select a reputable exchange with a user-friendly interface, strong security measures, and a wide range of supported cryptocurrencies.

Security Measures

Implement robust security practices, including two-factor authentication (2FA), strong passwords, and cold storage for your assets.

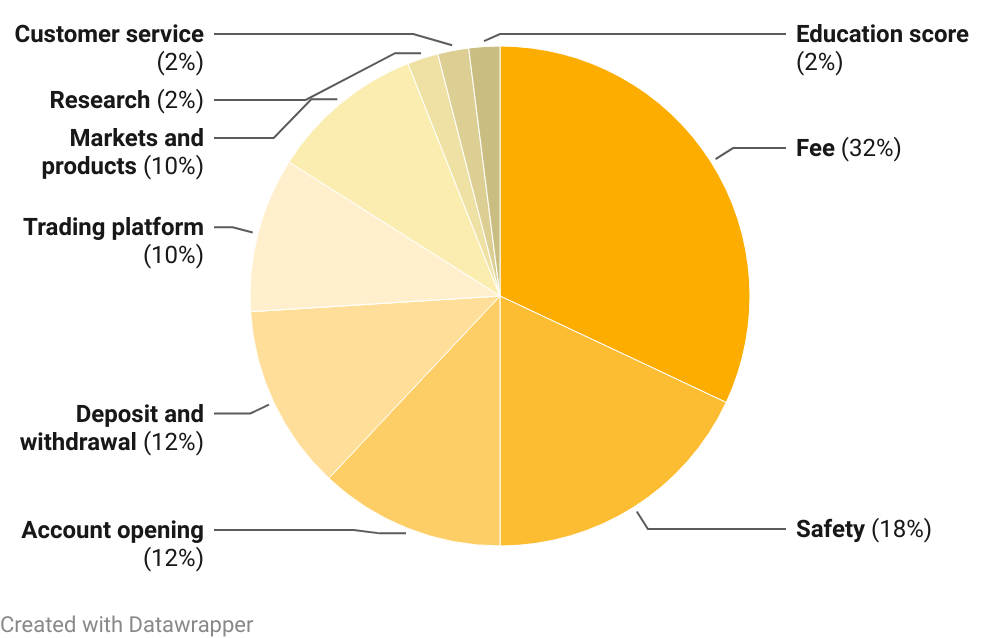

Weight Of Areas In The Methodology

Basic Crypto Trading Strategies

HODLing

HODLing involves holding onto cryptocurrencies for the long term, based on the belief in their future potential.

Day Trading

Day traders buy and sell cryptocurrencies within the same day, capitalizing on short-term price fluctuations.

Swing Trading

Swing traders aim to capture price swings within an established trend, holding positions for several days or weeks.

Advanced Crypto Trading Strategies

Scalping

Scalpers make rapid, small trades to profit from tiny price movements. It requires quick decision-making and execution.

Arbitrage

Arbitrage involves exploiting price differences for the same cryptocurrency on different exchanges, profiting from the price gap.

Algorithmic Trading

Algorithmic trading uses automated trading algorithms to execute orders based on predefined criteria, such as technical indicators or news events.

Risk Management in Crypto Trading

-

01

Position Sizing

Determine the size of your trades based on your risk tolerance and account size. Never risk more than you can afford to lose.

-

02

Stop-Loss and Take-Profit Orders

Use stop-loss orders to limit potential losses and take-profit orders to secure profits at predefined levels.

-

03

Managing Emotions

Emotions like fear and greed can cloud judgment. Maintain emotional discipline by adhering to your trading plan.

Technical Analysis in Crypto Trading

Candlestick Patterns

Candlestick charts provide insights into price trends and reversals, helping traders make informed decisions.

Support and Resistance

Identifying support and resistance levels can assist in predicting price movements and potential entry/exit points.

Indicators and Oscillators

Technical indicators like Moving Averages, RSI, and MACD offer valuable signals for trading decisions.

Fundamental Analysis in Crypto Trading

Evaluating Projects and Teams

Research the fundamentals of cryptocurrencies, including their technology, use case, team, and partnerships.

News and Events

Stay informed about news and events that can impact cryptocurrency prices, such as regulatory developments and major partnerships.

Regulatory Considerations

Understand the regulatory landscape in your jurisdiction to ensure compliance.

Psychology of Crypto Trading

Overcoming Fear and Greed

Managing emotions is essential. Fear can lead to missed opportunities, while greed can result in excessive risk-taking.

Staying Disciplined

Stick to your trading plan, even during turbulent market conditions or tempting opportunities.

Learning from Losses

Losses are part of trading. Use them as opportunities to learn and improve your strategy.

Common Mistakes to Avoid

Neglecting Security

Prioritize security to protect your assets from theft or hacking.

Chasing Hype

Avoid investing in cryptocurrencies solely based on hype or speculative trends.

Ignoring Diversification

Diversify your crypto portfolio to reduce risk.

Staying Informed and Adapting

Market Research and News

Stay updated on market trends, news, and developments that can impact cryptocurrency prices.

Adapting to Market Conditions

Be flexible and adapt your trading strategy to changing market conditions.

Continuous Learning

The crypto market is constantly evolving. Commit to continuous learning and improvement.

Conclusion

Cryptocurrency trading offers exciting opportunities for profit, but it’s essential to approach it with knowledge and caution. With a solid understanding of the fundamentals, robust security measures, effective risk management, and emotional discipline, you can navigate the world of crypto trading confidently. Remember that crypto markets are highly volatile, so always be prepared for the unexpected. Happy trading!