- MetaTrader 4

- MetaTrader 5

- WebTrader

- SCA(UAE)

- FSA(Seychelles)

- FCA(UK)

- $100

- 4.7/5

Regulation and Security

EQUITI operates under the stringent regulation of the SCA (UAE), FSA (Seychelles) and FCA (UK), a well-respected financial regulatory authority. They impose strict requirements on brokers, encompassing aspects such as capital adequacy, risk management, and client protection.

EQUITI places a strong emphasis on security measures to safeguard clients’ funds and data. These measures include:

-

01

Segregated client accounts

EQUITI maintains a clear separation between client funds and its own, ensuring the protection of client funds even in the event of the broker’s insolvency.

-

02

Negative balance protection

EQUITI offers negative balance protection, meaning clients cannot lose more than the amount they’ve deposited in their account.

-

03

Data security

EQUITI employs various security protocols to protect client data, including encryption and firewalls.

Trading Platforms

EQUITI grants access to both the highly popular MetaTrader 4 and MetaTrader 5 trading platforms. These platforms are renowned for their user-friendliness and a wide array of features and tools for trading.

In addition to MetaTrader 4 and MetaTrader 5, EQUITI provides a web-based trading platform, perfect for traders who prefer not to download any software.

Advantages

- Competitive pricing with attractive spreads and commissions.

- A low minimum deposit requirement.

- A wide selection of trading instruments.

- Stringent regulation by the DFSA.

- Availability of both MetaTrader 4 and MetaTrader 5 trading platforms.

- Educational resources tailored for novice traders.

- Access to customer support 24/5.

Disadvantages

- A limited range of account types.

- Absence of copy trading and social trading features.

- Not as widely recognized as some other forex brokers.

- Occasional delays in customer support.

- A restricted choice of funding methods.

- The absence of Islamic trading accounts.

Deposits & Withdrawals:

EQUITI offers multiple options for deposits and withdrawals, including bank wire transfer, credit/debit card, and e-wallets. The minimum deposit requirement stands at $100.

EQUITI ensures swift and efficient withdrawal processing, with most withdrawals being handled within 24 hours.

Instrument Selection

EQUITI’s diverse range of trading products comprises:

- Forex: Offering access to over 60 currency pairs for trading.

- Stocks: With a selection of over 10,000 stocks available for trading.

- Commodities: Including gold, silver, oil, and wheat, among other options.

- Indices: Incorporating a variety of indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq 100.

Account Types

EQUITI offers various account types tailored to cater to the diverse needs of traders. These include:

- ECN Zero account: Featuring commission-free trading with a spread mark-up of 0.1 pips.

- ECN Pro account: Offering commission-free trading with a spread mark-up of 0.0 pips.

- Standard account: Providing commission-free trading with a spread mark-up of 0.8 pips.

Leverage and Margin

EQUITI extends leverage up to 1:500, allowing traders to control more substantial positions with relatively modest capital. However, it’s essential to recognize that leverage can amplify both gains and losses.

The margin requirement for forex trading is set at 1%, necessitating traders to have at least $1 in their account for every $100 position they control.

Educational Resources

EQUITI goes the extra mile by offering a wide array of educational resources, including:

- Trading webinars and seminars.

- Trading articles and videos.

- E-books and trading guides.

Customer Support

EQUITI ensures 24/5 customer support in multiple languages. Clients can reach out to the support team through live chat, email, or phone.

Fees and Spreads

EQUITI boasts competitive spreads and commissions. The ECN Zero account starts with spreads as low as 0.1 pips, while the ECN Pro account offers spreads as low as 0.0 pips.

For trading on the Standard account, EQUITI levies a commission of $0.8 per round trip.

Evaluation of the most influential parameters of Bull79

NOTE!

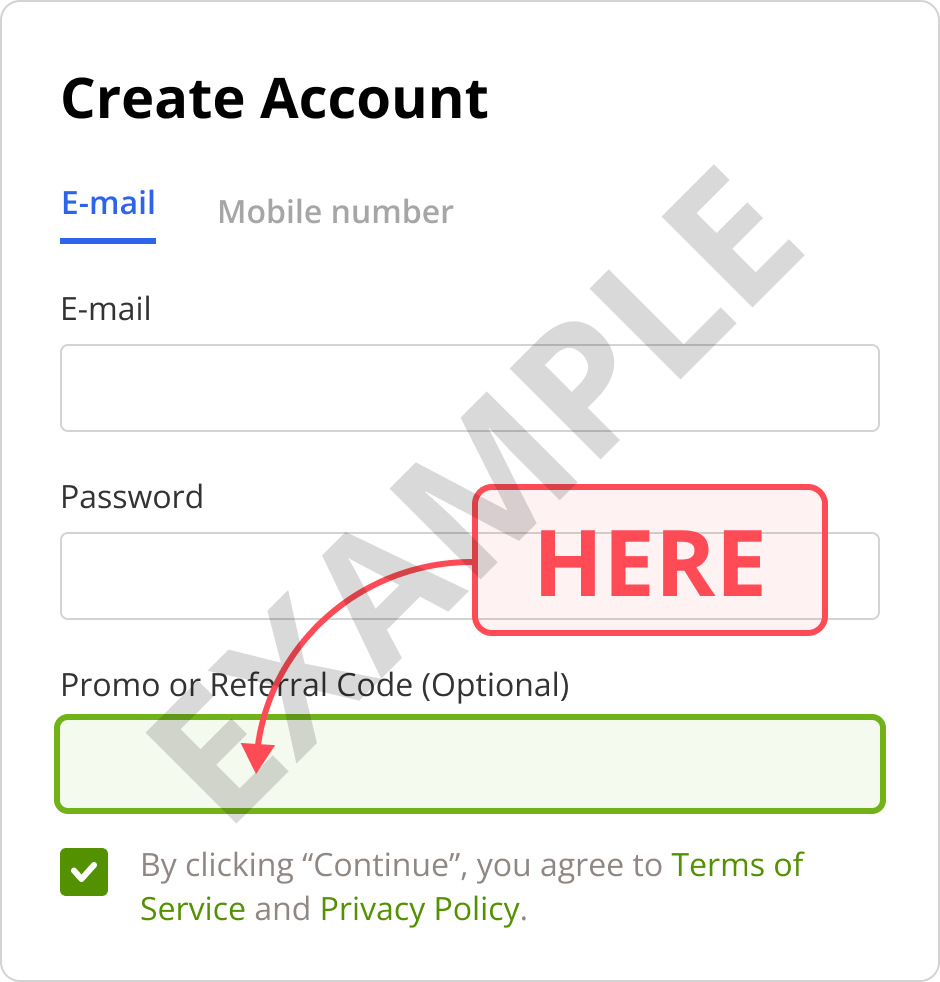

Don’t Miss Out on Exclusive Monthly Bonuses and Extra Trading Payouts with EQUITI!

*Please note that Bull79 may receive a partnership reward for client registrations through their referral link.

Conclusion

EQUITI emerges as an excellent choice for forex traders seeking a trustworthy and regulated broker. It stands out for its competitive pricing in terms of spreads and commissions, extensive instrument selection, and a comprehensive set of services and educational resources.