The UAE is a growing hub for forex trading, with a number of reputable brokers offering their services to residents. This table compares the 6 best forex brokers in the UAE in 2023, based on a number of factors, including fees, minimum deposit, maximum leverage, trading platforms, regulation, trust rating, and star reviews.

| Ranking | Broker | Fees (spreads from and commission) | Min. Deposit | Max. Leverage | Trading Platforms | Regulation (Country) | Trust Rating | Star Reviews | Open an account |

|

|

|

0 pips + commission, spreads from0.9 pips | $100 | 1:400 |

|

|

Good | 4.2/5 |

|

|

|

|

0 pips+ commission, spreads from 0.1 pips | $100 | 1:500 |

|

|

Excellent | 4.7/5 |

|

|

|

|

0.8 pips+ commission, spreads from 0.1 pips | $25 | 1:500 |

|

|

Good | 4.1/5 |

|

|

4

|

|

0 pips+ commission, spreads from0.5 pips | $50 | 1:500 |

|

|

Good | 4.3/5 |

|

|

5

|

|

0.9 pips+ commission, spreads from 0.5 pips | $50 | 1:500 |

|

|

Good | 4/5 |

|

|

6

|

|

1 pip+ commission, spreads from 0.9 pips | $100 | 1:500 |

|

|

Good | 3.9/5 |

|

|

7

|

|

0.8 pip+ commission, spreads from $0.05 pips | $100 | 1:500 |

|

|

Good | 4.5/5 |

Are you more inclined towards visual learning? If so, indulge in our video summary of this article.

AvaTrade is a global forex and CFD broker, established in 2006, with its headquarters located in Dublin, Ireland. It is under the regulatory oversight of various financial authorities, including ASIC (Australia), ADGM (UAE) and FSCA (South Africa).

Advantages

- Diverse selection of trading products.

- Stringent regulation by multiple financial authorities.

- Access to both MetaTrader 4 and MetaTrader 5 trading platforms.

- Provision of educational resources for novice traders.

- Availability of customer support 24/5.

- Acceptance of multiple currencies.

- Availability of demo accounts for practice.

Disadvantages

- Spreads and commissions are comparatively higher than some competing brokers.

- A limited variety of account types.

- Absence of copy trading or social trading features.

- Lesser recognition compared to certain other forex brokers.

- Occasional delays in customer support.

- A restricted choice of funding methods.

- The unavailability of Islamic trading accounts.

Commissions: AvaTrade offers a variety of commission structures, which differ depending on the chosen account type. For example, the AvaTradeGO account allows for commission-free trading with a spread mark-up of 0.9 pips.

Web Platforms: AvaTrade provides both the MetaTrader 4 and MetaTrader 5 trading platforms, two of the most popular choices in the global forex trading arena. MetaTrader 4 is a user-friendly platform suitable for traders of all experience levels, while MetaTrader 5 is a more advanced platform with added features and functionality.

Deposits & Withdrawals: AvaTrade supports a range of deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit requirement is set at $100.

Conclusion: AvaTrade is a viable option for traders in search of a trustworthy and regulated forex broker. It presents an extensive assortment of trading products, access to both MetaTrader 4 and MetaTrader 5 trading platforms, and round-the-clock customer support. However, it’s important to acknowledge that AvaTrade’s spreads and commissions are on the higher side compared to certain other brokers, and it offers a limited variety of account types.

Evaluation of the most influential parameters of Bull79

EQUITI is a multi-asset brokerage firm that provides an extensive array of trading options, encompassing forex, stocks, commodities, and indices. The company is headquartered in Dubai, United Arab Emirates, and is subject to regulation by the SCA (UAE), FSA (Seychelles) and FCA (UK).

Advantages

- Competitive pricing with attractive spreads and commissions.

- A low minimum deposit requirement.

- A wide selection of trading instruments.

- Stringent regulation by the SCA (UAE), FSA (Seychelles) and FCA (UK).

- Availability of both MetaTrader 4 and MetaTrader 5 trading platforms.

- Educational resources tailored for novice traders.

- Access to customer support 24/5.

Disadvantages

- A limited range of account types.

- Absence of copy trading and social trading features.

- Not as widely recognized as some other forex brokers.

- Occasional delays in customer support.

- A restricted choice of funding methods.

- The absence of Islamic trading accounts.

Commissions: EQUITI offers a variety of commission structures, which vary according to the chosen account type. For example, the ECN Zero account allows commission-free trading with a spread mark-up of 0.1 pips.

Web Platforms: EQUITI provides both the MetaTrader 4 and MetaTrader 5 trading platforms, two of the most popular options globally. MetaTrader 4 is a user-friendly platform suitable for traders of all experience levels, while MetaTrader 5 is a more advanced platform offering enhanced features and functionality.

Deposits & Withdrawals: EQUITI supports various deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit requirement stands at $100.

Conclusion: EQUITI is a solid choice for traders seeking a trustworthy and regulated forex broker. It delivers a broad spectrum of trading products, competitive pricing, and access to both MetaTrader 4 and MetaTrader 5 trading platforms. However, it’s important to bear in mind that EQUITI has a limited range of account types and does not offer copy trading or social trading functionalities.

Evaluation of the most influential parameters of Bull79

Multibank is a global forex and CFD broker that was established in 2005. Its headquarters are located in Sydney, Australia, and it is subject to regulation by the SCA (UAE), CIMA (Cayman Island), MAS (Singapore) and ASIC (Australia).

Advantages

- An extensive variety of trading products.

- Competitive pricing with attractive spreads and commissions.

- Stringent regulation by multiple financial authorities.

- Access to both MetaTrader 4 and MetaTrader 5 trading platforms.

- Provision of educational resources for novice traders.

- Round-the-clock customer support.

- Acceptance of multiple currencies.

Disadvantages

- A limited selection of account types.

- The absence of copy trading or social trading features.

- Lesser recognition compared to certain other forex brokers.

- Occasional delays in customer support.

- A restricted choice of funding methods.

- The unavailability of Islamic trading accounts.

Commissions: Multibank offers a variety of commission structures, which differ depending on the chosen account type. For instance, the Raw ECN account allows for commission-free trading with a spread mark-up of 0.8 pips.

Web Platforms: Multibank provides both the MetaTrader 4 and MetaTrader 5 trading platforms, two of the most popular choices in the global forex trading arena. MetaTrader 4 is a user-friendly platform suitable for traders of all experience levels, while MetaTrader 5 is a more advanced platform with added features and functionality.

Deposits & Withdrawals: Multibank supports a range of deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit requirement is set at $25.

Conclusion: Multibank presents a reliable and regulated option for traders seeking a diverse array of trading products and competitive spreads and commissions. It also provides access to both MetaTrader 4 and MetaTrader 5 trading platforms. Nonetheless, it’s crucial to acknowledge that Multibank has a limited variety of account types and does not offer copy trading or social trading features.

Evaluation of the most influential parameters of Bull79

ATFX is a forex and CFD brokerage established in 2006. The company is headquartered in London, United Kingdom, and is subject to regulation by the SCA (UAE), FCA (UK), CySEC (Cyprus) and FSC (Mauritius).

Advantages

- Competitive pricing with attractive spreads and commissions.

- A diverse array of trading instruments.

- Stringent regulation by the SCA (UAE), FCA (UK), CySEC (Cyprus) and FSC (Mauritius).

- Availability of both MetaTrader 4 and MetaTrader 5 trading platforms.

- Access to educational resources tailored for novice traders.

- Customer support available 24/5.

- Acceptance of multiple currencies.

Disadvantages

- A limited selection of account types.

- Absence of copy trading and social trading features.

- Not as widely recognized as some other forex brokers.

- Occasional delays in customer support.

- A restricted choice of funding methods.

- The absence of Islamic trading accounts.

Commissions: ATFX offers a variety of commission structures, which vary according to the chosen account type. For instance, the Raw ECN account allows commission-free trading with a spread mark-up of 0.5 pips.

Web Platforms: ATFX provides both the MetaTrader 4 and MetaTrader 5 trading platforms, two of the most popular options in the forex trading world. MetaTrader 4 is a user-friendly platform suitable for traders of all experience levels, while MetaTrader 5 is a more advanced platform offering enhanced features and functionality.

Deposits & Withdrawals: ATFX supports various deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit requirement stands at $50.

Conclusion: ATFX is a solid choice for traders seeking a trustworthy and regulated forex broker. It offers a broad selection of trading products, competitive pricing, and access to both MetaTrader 4 and MetaTrader 5 trading platforms. However, it’s important to note that ATFX has a limited range of account types and does not offer copy trading or social trading functionalities.

Evaluation of the most influential parameters of Bull79

AUS Global is an Australian-based forex and CFD brokerage firm, established in 2013. The company’s headquarters are situated in Sydney, Australia, and it operates under the regulatory oversight of the ASIC (Australia) and CySEC (Cyprus).

Advantages

- An extensive array of trading products.

- Competitive pricing, including attractive spreads and commissions.

- Regulation by multiple financial authorities.

- Access to both MetaTrader 4 and MetaTrader 5 trading platforms.

- Provision of educational resources tailored for novice traders.

- Round-the-clock customer support.

- Acceptance of multiple currencies.

Disadvantages

- A limited selection of account types.

- The absence of copy trading or social trading features.

- Lesser recognition compared to some other forex brokers.

- Occasional delays in customer support.

- A restricted choice of funding methods.

- The unavailability of Islamic trading accounts.

Commissions: AUS Global offers various commission structures, which differ depending on the selected account type. For instance, the Raw ECN account permits commission-free trading, with a spread mark-up of 0.9 pips.

Web Platforms: AUS Global provides both the MetaTrader 4 and MetaTrader 5 trading platforms, both being highly popular in the global forex trading community. MetaTrader 4 is a user-friendly platform suitable for traders of all experience levels, while MetaTrader 5 is a more advanced platform offering a broader range of features and functionalities.

Deposits & Withdrawals: AUS Global supports various deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit requirement is set at $50.

Conclusion: For traders in search of a dependable and regulated forex broker, AUS Global is a suitable choice. It provides a wide spectrum of trading products, competitive spreads, commissions, and access to both MetaTrader 4 and MetaTrader 5 trading platforms. However, it’s important to be aware that AUS Global offers a limited range of account types and does not include features for copy trading or social trading.

Evaluation of the most influential parameters of Bull79

Startrader is a forex broker based in Seychelles, established in 2019. It offers a diverse selection of trading products, encompassing forex, commodities, indices, and shares. Startrader operates under the regulation of the FSA (Seychelles) and CySEC (Cyprus).

Advantages

- A wide array of trading products.

- Competitive pricing, including attractive spreads and commissions.

- Regulation by the FSA (Seychelles) and CySEC (Cyprus).

- Availability of both MetaTrader 4 and MetaTrader 5 trading platforms.

- Provision of educational resources tailored for new traders.

- Round-the-clock customer support.

- Acceptance of multiple currencies.

Disadvantages

- A limited variety of account types.

- The absence of copy trading or social trading features.

- Lower recognition in comparison to some other forex brokers.

- Occasional delays in customer support.

- A limited choice of funding methods.

- The non-availability of Islamic accounts.

Commissions: Startrader provides a variety of commission structures, which vary based on the chosen account type. For example, the Standard account offers spreads of 1 pip with additional commission, while the ECN account allows for commission-free trading with a spread mark-up of 0.9 pips.

Web Platforms: Startrader presents both the MetaTrader 4 and MetaTrader 5 trading platforms, both being among the most widely used platforms in the global forex trading arena. MetaTrader 4 is a user-friendly platform suitable for traders of all experience levels, while MetaTrader 5 is a more advanced platform offering an extended range of features and functionalities.

Deposits & Withdrawals: Startrader supports various deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit requirement is set at $100.

Conclusion: For traders seeking a reliable and regulated forex broker with an extensive array of trading products, as well as competitive spreads and commissions, Startrader is a suitable choice. Nonetheless, it is crucial to note that Startrader offers a limited variety of account types and does not incorporate features for copy trading or social trading.

Evaluation of the most influential parameters of Bull79

Maleyat is a relatively recent addition to the world of forex brokers, having been established in 2023. The company is headquartered in Dubai, United Arab Emirates, and operates under the regulatory oversight of FSCA (South Africa). Maleyat provides an extensive array of trading products and services, including offerings in forex, CFDs, and cryptocurrencies.

Advantages

- Competitive pricing in terms of spreads and commissions.

- A broad selection of trading products and services.

- User-friendly trading platforms.

- Regulatory compliance under the FSCA (South Africa)

- Strong customer support services.

- A low minimum deposit requirement.

- Swift withdrawal processing

Disadvantages

- A lack of an established track record as a relatively new broker.

- Limited availability of educational resources.

- Absence of a copy trading platform.

- Islamic accounts are not offered.

- High leverage.

- Limited brand recognition in the industry.

- A constrained range of payment options.

Commissions: For all trades, Maleyat imposes a commission of $0.05 per lot.

Web Platforms: Maleyat provides access to web-based trading platforms for both MetaTrader 4 and MetaTrader 5.

Deposits & Withdrawals: Maleyat facilitates deposits and withdrawals through various methods, including bank wire transfer, credit/debit card, and e-wallets. The minimum deposit requirement stands at $100. The broker is known for its swift and efficient withdrawal processing, with most requests completed within 24 hours.

Conclusion: Maleyat stands as a favorable choice for forex traders in the UAE who seek the services of a trustworthy and regulated broker offering competitive pricing in terms of spreads and commissions, alongside a wide range of trading products and services. However, it is important to acknowledge that Maleyat is a newcomer to the brokerage scene, boasting a limited track record and offering relatively fewer educational resources.

Evaluation of the most influential parameters of Bull79

Navigating the Forex Market: Choosing the Perfect

Are you ready to embark on your forex trading journey? Selecting the ideal broker is a critical first step to ensure a smooth and successful experience. Our comprehensive guide will walk you through the essential factors to consider when choosing the perfect forex broker that aligns with your unique needs.

-

01

Regulation and Licensing

Begin your search by ensuring the broker is regulated by a reputable financial authority in your region. Regulatory oversight helps protect your investments and ensures the broker adheres to strict ethical standards.

-

02

Security

Your financial and personal information should be safeguarded at all times. Verify that the broker employs top-notch security measures, including encryption technology, to protect your data.

-

03

Trading Platform

Your chosen trading platform is your gateway to the forex market. Evaluate its user-friendliness, reliability, and the availability of essential tools like technical analysis, charts, and diverse order types.

-

04

Trading Costs

Keep an eye on spreads, commissions, and any hidden fees that might impact your trading costs. Understanding the complete cost structure is vital for effective financial planning.

-

05

Currency Pairs

Diversification is key to managing risk. Ensure the broker offers a wide range of currency pairs, including major, minor, and exotic pairs, to match your trading preferences.

-

06

Leverage

While leverage can amplify profits, it also increases the potential for losses. Assess the broker’s leverage offerings and only utilize it if it aligns with your risk tolerance and strategy.

-

07

Customer Support

Reliable customer support is your lifeline in times of need. Test the broker’s responsiveness, availability, and expertise to ensure they can assist you promptly.

-

08

Account Types

Different traders have different needs. Examine the various account types the broker offers and select one that suits your trading experience and goals.

-

09

Deposit and Withdrawal Methods

Convenience matters when it comes to funding your trading account and withdrawing profits. Evaluate the ease and speed of these processes, as well as any associated fees.

-

10

Educational Resources

Continuous learning is key to success. Look for brokers that provide educational materials, webinars, and analysis tools to help you enhance your trading skills and knowledge.

With these essential considerations in mind, you’ll be well-equipped to navigate the forex market and choose the broker that best fits your trading aspirations. Your journey begins here, and a well-informed decision today can pave the way for a profitable tomorrow.

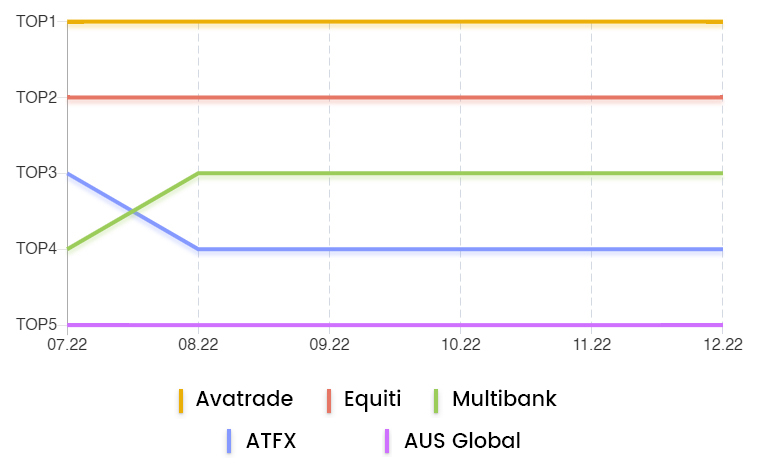

Average score of the Top 5 brokers on the Bull79 ratings list

Discover valuable insights!

We’ve created thematic assessments of Forex brokers across various criteria to simplify your decision-making process when choosing the perfect broker for your specific requirements. Explore distinct Top Broker categories tailored for novice traders, investors, and brokers holding specialized licenses, ensuring you find the ideal match for your needs.

Top Forex brokers for beginner traders

Here are some of the best forex brokers for beginner traders in the UAE, based on the factors mentioned above:

-

01

Startrader

Startrader distinguishes itself by offering an extensive range of trading products, including forex, commodities, indices, and shares, while maintaining competitive pricing in terms of spreads and commissions. However, it’s worth noting that Startrader is a relatively new entrant in the brokerage industry and lacks the same level of recognition as some other brokers listed here.

-

02

Multibank

Multibank earns its appeal by presenting a low minimum deposit requirement, along with competitive pricing regarding spreads and commissions. Additionally, it is regulated by the SCA (UAE), CIMA (Cayman Island), MAS (Singapore) and ASIC (Australia), a reputable financial regulatory authority.

-

03

Maleyat

Maleyat is a good choice for beginner traders in the UAE because it offers a low minimum deposit, competitive spreads and commissions, and a variety of trading products and services. However, it is important to note that Maleyat is a new broker with less track record and limited educational resources.

-

04

AvaTrade

AvaTrade, a globally recognized forex broker, extends its services to traders in the United Arab Emirates (UAE). In this comprehensive review, we delve deeper into AvaTrade’s offerings, trading platforms, regulatory compliance, educational resources, and more, to help UAE traders make an informed decision.

-

05

EQUITI

EQUITI stands out due to its extensive collection of educational resources tailored for novice traders, in addition to its competitive pricing with attractive spreads and commissions. Moreover, it is under the regulation of the SCA (UAE), FSA (Seychelles) and FCA(UK), a highly respected financial regulatory body.

-

06

ATFX

ATFX is another favorable choice for newcomers in the trading world, offering an array of educational materials and competitive pricing in terms of spreads and commissions. It is also subject to oversight by the SCA(UAE), FCA(UK), CySEC(Cyprus) and FSC(Mauritius), a widely respected financial regulator.

-

07

AUS Global

AUS Global is another suitable option for beginners, as it maintains a low minimum deposit requirement and provides competitive spreads and commissions. It is also subject to the supervision of the ASIC (Australia) and CySEC (Cyprus), a highly esteemed financial regulator.

Forex companies with European licenses

All of the below brokers are regulated by highly respected financial regulators, and they all offer a variety of trading products and services. However, there are some key differences between them, such as their minimum deposit requirements and the range of European licenses they hold.

| Position | Broker | European Licenses | Minimum Deposit | Regulator | Open an account |

|

1

|

|

|

$100 |

|

|

|

2

|

|

|

$25 |

|

|

|

3

|

|

|

$100 |

|

|

|

4

|

|

|

$50 |

|

|

|

5

|

|

|

$50 |

|

|

|

6

|

|

|

$50 |

|

The best forex company for you will depend on your individual needs and preferences. If you are a beginner trader, you may want to consider a broker with a low minimum deposit

requirement and a variety of educational resources. If you are an experienced trader, you may want to consider a broker with a wider range of trading products and services.

Additional Aspects to Keep in Mind

When making a decision about which forex broker to opt for, there are several other factors you should take into account, including:

-

01

Spreads and Commissions:

Spreads and commissions are the costs imposed by brokers for their services. It’s crucial to compare these fees across different brokers before settling on one.

-

02

Trading Platforms:

Forex brokers typically provide a range of trading platforms. Selecting a broker that offers a user-friendly platform that aligns with your specific requirements is essential.

-

03

Customer Support:

Prioritizing a broker with efficient customer support is vital. This aspect holds particular significance for novice traders who may require assistance when initiating their trading journey.

Forex brokers for investors using PAMM

PAMM accounts represent a specific category of forex trading accounts where investors combine their capital to invest in a professionally managed forex account. This presents an attractive alternative for individuals interested in forex trading but lacking the time or expertise to oversee their own accounts.

The subsequent table showcases the leading 5 forex brokers catering to investors utilizing PAMM accounts.

| Position | Broker | PAMM Account | Minimum Deposit | Regulator | Open an account |

|

1

|

|

|

$100 |

|

|

|

2

|

|

|

$50 |

|

|

|

3

|

|

|

$25 |

|

|

|

4

|

|

|

$100 |

|

|

|

5

|

|

|

$100 |

|

|

|

6

|

|

|

$50 |

|

|

|

7

|

|

|

$50 |

|

Every broker listed here offers viable choices for investors interested in PAMM accounts. Nonetheless, conducting your own due diligence is essential before committing to a specific broker. It’s imperative to carefully review the terms and conditions, comprehending the risks associated with PAMM trading.

Further Considerations

When selecting a forex broker for your PAMM account, several other factors warrant your attention, such as:

-

01

Performance:

Thoroughly researching the performance of PAMM managers prior to making an investment is crucial. This can be accomplished by perusing reviews and analyzing historical performance data.

-

02

Fees:

PAMM managers typically impose charges for their services. It’s vital to compare these fees across various managers to make an informed decision.

-

03

Risk Management:

Opting for a PAMM manager with an effective risk management strategy is paramount. Such a strategy serves as a safeguard against significant losses, shielding your investment.

Forex brokers for Bitcoin trading

Bitcoin is a form of digital or virtual currency, existing solely in electronic form. It operates in a decentralized manner, free from government or financial institution oversight. Bitcoin is actively traded on forex markets, similar to traditional currencies.

The subsequent table outlines the leading 5 forex brokers catering to Bitcoin trading, drawn from the larger list of 7 brokers you have provided.

| Position | Broker | Minimum Deposit | Type of Broker | Open an account |

|

1

|

|

$25 |

|

|

|

2

|

|

$50 |

|

|

|

3

|

|

$100 |

|

|

|

4

|

|

$100 |

|

|

|

5

|

|

$50 |

|

|

|

6

|

|

$50 |

|

|

|

7

|

|

$100 |

|

Each broker featured in this compilation provides solid choices for engaging in Bitcoin trading. They offer competitive spreads and commissions while also facilitating Bitcoin deposits and withdrawals. Nonetheless, it’s crucial to conduct your individual research before making a selection. Take into account your specific requirements and preferences, including your trading expertise, financial constraints, and investment objectives.

Supplementary Considerations

When in the process of picking a forex broker for Bitcoin trading, a few supplementary aspects may deserve your attention, such as:

-

01

Security:

It’s imperative to opt for a broker with a reputable security track record. This ensures the safeguarding of your Bitcoin holdings from potential theft.

-

02

Customer Support:

Prioritizing a broker with responsive customer support is essential, especially for novice traders who may require guidance as they embark on their trading journey.

Forex Brokers by Countries

Forex Brokers in US

Forex Brokers in Australia

Forex Brokers in South Africa

Forex Brokers in UAE

Forex Brokers in India

Forex Brokers in Singapore

Forex Brokers in United Kingdom

Bull79’s forex forum is a treasure trove of information for traders of all levels. From newbie questions to expert analysis, the community is always willing to share their knowledge and expertise.

SARAH THOMPSON

Bull79’s forex comparison website is my go-to resource when it comes to finding the best forex brokers in the world. Their platform is easy to use, and the information is always up to date and reliable.

JOHN CARTER

Bull79’s forex broker comparison saved me hours of research and helped me find the right broker for my trading strategy. I highly recommend their expert reviews and insights to anyone looking to get into forex trading.

EMMA RODRIGUEZ

Bull79’s forex forum is an invaluable resource for traders looking to stay up to date with the latest market trends and insights. The community is friendly and knowledgeable, and I’ve learned a lot from their expertise.

DAVID WILSON

Bull79 FAQs

-

01

What is Forex trading?

Forex trading involves the exchange of one currency for another with the aim of making a profit from fluctuations in exchange rates.

-

02

How does the Forex market operate?

The Forex market operates 24 hours a day, five days a week, with participants trading currencies electronically.

-

03

What are major currency pairs?

Major currency pairs are those that involve the most widely traded currencies, such as EUR/USD, GBP/USD, and USD/JPY.

-

04

What are exotic currency pairs?

Exotic currency pairs include one major currency and one from a smaller or emerging market, like USD/TRY (U.S. Dollar/Turkish Lira).

-

05

What are exotic currency pairs?

Exotic currency pairs include one major currency and one from a smaller or emerging market, like USD/TRY (U.S. Dollar/Turkish Lira).

-

05

What is a pip?

A pip, or “percentage in point,” is the smallest price move that a given exchange rate can make.

-

06

What is leverage in Forex trading?

Leverage allows traders to control a larger position size with a smaller amount of capital.

Forex Brokers in the Market

Conclusion

Each of these distinguished forex brokers offers its own set of advantages and limitations. When selecting a broker, consider factors such as your trading preferences, the range of available assets, platform features, regulatory standing, and associated costs. Thorough research and assessment of your trading goals are essential to align yourself with the broker that best supports your journey in the forex market. Remember that trading involves risk, and making informed decisions is crucial to your success in the financial markets.